Features

Valuing Trademarks in China: A Perspective on Common Methods

Published: June 16, 2021

Chris Fung Beijing Lifang & Partners Law Firm Beijing, China

By one measure, the value of the top 100 brands in China has steadily risen over the past decade and increased 12 percent last year alone. (Kantar, Brand Z China Report). According to Brand Finance’s 2021 brand ranking, Chinese brands accounted for 20 percent of total brand value. Other measures may tell a different story.

In the knowledge-based economy, businesses increasingly value intangible assets such as brands, leading to questions of how they are valued and lessons about valuation models. This article looks at the brand valuation models used in China, where the highest number of trademark applications are received worldwide.

A discussion of Chinese laws, regulations, and practices contribute insights into this topic should be of interest to brand owners and professionals in all jurisdictions. The methods used in China are in line with those commonly used globally.

In China, trademark valuation is primarily done by appraisal professionals “who have passed the appraiser qualification examination.” Art. 8, Asset Appraisal Law. They use various methods, alone or in combination, to value trademarks and produce appraisal reports. Understanding such methods will help report-users to understand the basis for valuation, object to the content of such reports, and seek corrections.

Some trademarks have real monetary value and allow brand owners to distinguish themselves from others, charge a premium or sell more of their products or services, or gain some other commercial advantage. These advantages can increase revenue, are a good measure of a business’s ability to sell a product or service, and can boost shareholder value.

There are three basic appraisal methods, namely, the cost approach, market approach, and the cash flow approach. The accounting method and the royalty relief method are considered derivative methods. The Notice of the China Appraisal Society on Promulgation of the Revised Guidelines for Intellectual Property Asset Appraisal states that “Whoever carries out … intellectual property asset appraisal shall analyze the applicability of the … basic methods and choose an appraisal method… [appropriate for the] purpose, appraisal target, type of value and document collection, etc.” Xong Ping Xie, 2017, No. 44, Art. 23.

As a matter of general practice, the author prefers using revenue rather than profit for valuation since profit is arguably easier to manipulate, as shown in the example below:

Courier Company wants to license the trademarks for KD Express (which is famous for logistics and delivery services) from KD Co. Courier Company values the trademarks based on KD Co.’s profits and industry growth projections. However, KD Co. has been depreciating the value of its vehicles and other assets over a period that is longer than the lifespans of the assets. This reduces business expenses and inflates profits. Valuing the trademark based on the reported profits of KD Co. would inflate its value.

Although revenue is harder to manipulate, people can manipulate it, nevertheless. Accordingly, valuation report users should be financially literate and evaluate such reports with a critical eye.

Cost Approach

The cost approach focuses on the question:

How much would it cost to develop a similar brand?

This approach considers a brand’s value as equal to its owner’s investment in marketing and advertising. Using this approach can be challenging and may require guesswork or access to the target brand’s accounts. The difficulty of this method can correlate with the age of the company.

Consider the following, based on a real example:

In 2019, a brand was valued at around US $80 billion. To achieve this, the brand had to invest money in marketing and advertising, develop and deliver products, and survive since its founding in the nineteenth century.

Imagine the daunting task of reviewing more than 100 years of accounts. Sometimes judgment calls must be made during valuation.

Another issue is when a valuable brand suffers damaging blows. Consider an airplane manufacturer. Its brand could lose value if it experiences a series of fatal crashes.

Accordingly, the cost approach may be suitable for brands that have not faced any significant crises.

[Trademark value] can increase revenue, [is] a good measure of a business’s ability to sell something, and can boost shareholder value.

Market Approach

When you buy or sell a house, the price is often determined by the price of similar properties. At auctions, the price is determined by what others are bidding.

The market approach is based on the prices that others have paid or would be willing to pay for an asset. The asset’s characteristics are not always considered, but external factors are. Because the asset being valued is not essential in this approach, some consider this to be a method of pricing rather than valuation.

This method depends on suitable comparators and market data. However, finding a suitable comparator might be trickier than one might imagine. For instance, under this approach, the brand above was valued at US $69 billion in 2019, while a competing brand was valued at US $11 billion. This represents a big difference in what might be perceived by some as similar brands and complicates comparison.

In bullish environments, the market approach leads to the overvaluation of assets, while in bearish situations, it leads to undervaluation. Moreover, such valuations include implicit presumptions that cannot be clearly expressed, such as public optimism or economic growth. Regardless of its weaknesses, this approach is easy to understand, making it popular in many situations.

According to the Guidelines, the market approach “is usually chosen for the purpose of capital contribution, transfer, licensed use or other transactions.” The author suggests that those seeking valuations always request a secondary method in addition to this one because markets can behave unpredictably.

Cash Flow Approach

The cash flow approach treats an asset’s value as equal to the value of all cash flows from that asset discounted to present values. This approach is less popular as it can be challenging and depends on the explicit assumptions of the evaluator. However, it is a rational model that considers inherent value based upon asset characteristics.

Discounting cash flows to present value raises issues that are best highlighted by a simple example:

In October 2000, the cost of rice was around US $6 per hundredweights (CWT). By 2020, that price had reached around US $12.

Perhaps many readers have noticed during their lives that the cost of things increases and that the buying power of money often decreases. This phenomenon also affects the value of trademarks. A comprehensive trademark valuation should consider this by discounting the value of future cash flows, which should at least equal the cost of capital.

During cash flow‒based valuations, we should also consider how a trademark will generate future cash flow. This can be difficult and subject to assumptions, such as inflation, revenue growth, royalty rates, changes in brand premium generated by a trademark, the renewal and continued existence of the trademark, and the trademark owner being rational.

Unfortunately, predictions are less accurate the further into the future they go. After all, 10 years ago, who could have predicted what 2020 would be like? Consider the brands that have risen or fallen in value over the last decade.

The Guidelines recognize this problem, noting that “the reasonableness of the future earnings forecast shall be comprehensively judged by considering the factors such as the reasonable production scale, market share, technical and management level of the appraisal target.”

Accordingly, because it is difficult to predict the future, predictions should be based on the risk profile of the person relying on the valuation. A 10-year outlook is the general practice. Predictions can go further into the future for those who are risk-loving than for those who are risk averse. Suitable assumptions must be considered on a case-by-case basis. As a rule of thumb, stable businesses have more distant prediction horizons, while volatile businesses should have shorter ones.

To put things in perspective, consider the following example:

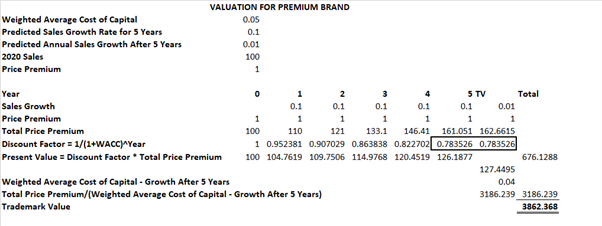

Premium Brand sells for 1 more than Generic Brand. Premium Brand has a brand premium of 1. Sales of Premium Brand were 100 in 2020. Analysts predict sales will increase by 10 percent per year for the next 5 years. We will assume that, after 5 years, growth slows to 1 percent. For simplicity, it is assumed that there is no cost in maintaining Premium Brand. The weighted average cost of capital of 5 percent shall be our discounting factor.

Using the discounted cash flow method, as shown below, the Premium Brand trademarks are worth 3,862.37.

The weighted average cost of capital (WACC) refers to the weighted average cost of debt, often in the form of interest paid, plus the cost of capital, which is the rate of return expected by investors.

The following is used to calculate WACC:

WACC= Cost of Equity×Percent of Equity + Cost of Debt×Percent of Debt

Growth figures often come from sales forecasts produced by marketing teams. Therefore, one might wish to adjust for the natural optimism that a marketing team might have, perhaps with the assistance of the organization’s finance team.

Note that this valuation method uses explicit assumptions, such as growth, WACC, and other things. These explicit assumptions can have an impact on negotiations and lead to disagreements over details.

Trademark valuation ... is often carried out using multiple methods.

Accounting Method

Another approach is the accounting method, which refers to the recorded book value of a trademark. This can be considered a derivative of the other methods as it refers to historic values. Such recorded values might have been obtained from an old transaction and lack relevance today. Moreover, under traditional accounting methods, an internally developed asset may lack value until sale or disposal, which creates problems in practice.

Consider the following example from the author:

You plant an acorn and it grows into an oak tree. Under traditional accounting methods, said oak tree has the same value as the acorn until sold. The oak tree is obviously more valuable than the acorn. However, by accounting convention, the oak tree has an equal value to the acorn.

A 2018 article by Travis Fairchild (O’Shaughnessy Asset Management, USA) highlights the real-world implications of the accounting method on brands. It provides comparisons between estimated brand values for 15 well-known companies. From his article, it is easy to see that this approach often results in undervaluation. Sellers should be wary of this method.

Royalty Relief Method

The royalty relief method is a common brand valuation method and is also known as the royalty saving method. It can be considered a derivate of the cash flow method. It uses the present value of future royalties for valuation. Future royalty payments can be limited to a specific time frame.

Consider the following example:

Drinks Co., a drinks maker, pays Blue Cow for a license to use the Blue Cow trademarks. Drinks Co. pays Blue Cow annual royalties for the license. The latest annual royalty was 100, and records show that it has steadily increased by 5 percent over the last few years. Royalty payments are predicted to grow steadily for the next five years.

| Year | 1 | 2 | 3 | 4 | 5 | Total |

| Royalty | 105 | 110.25 | 115.76 | 121.55 | 127.63 | 508.19 |

Note: Net present values (NPVs) are equal to future values for simplicity.

If Blue Cow were willing to sell its Chinese trademarks to Drinks Co. for less than 580.19, it would be a good price for Drinks Co. However, if it sold its trademark for more than 580.19, it would be a bad purchase price.

A would-be trademark purchaser that is not a licensee will have difficulty using this method. Moreover, the practice of making license agreements confidential compounds this difficulty.

Selecting the Right Valuation Method

All these methods have strengths and weaknesses. So, which method is best? The author opines that the best valuation method is the one that achieves your objectives. For instance, if you are the seller or a seller’s representative, you should use the valuation method that will help you to realize the best price. However, discovering what is the best method may require using and comparing multiple methods.

Collaboration and Use

Chinese appraisal professionals should work in collaboration with others. The circular about the Relevant Issues on Strengthening the Administration of Intellectual Property Asset Assessment states the following:

When carrying out the intellectual property assessment, an asset assessment institution may employ the experts in the aspects of patent, trademark, copyright and etc. to assist in the work, but the legal liabilities of the asset assessment institution and its certified asset assessors cannot thus be mitigated or exempted. (Art. 2, para. 2.)

Accordingly, a trademark valuation report should be produced by an appraisal professional in collaboration with intellectual property (IP) experts, such as trademark attorneys or other professionals qualified to talk about the validity of the IP. Such IP experts are often required to address the issue of trademark validity because invalidation reduces the value of a mark to zero. Where the risk of invalidation is unclear, the valuation can be risk adjusted.

Users should expect valuation reports to be produced by a collaborative multidisciplinary team so that they can obtain the best information possible. When a report is produced without the input of suitably qualified IP experts, users of reports should be wary. Report users might include a brand owner assessing the value of their trademark, or a potential buyer that wants to know the value of the trademark.

Reasons for using an appraisal professional include demonstrating fair value during transactions in which sellers face bankruptcy (Art. 31, Business Bankruptcy Law); showing due diligence to avoid negligence claims (Civil Code); or proving the discharge of obligations, such as making capital contributions (Civil Code, Business Bankruptcy Law, SPC Company Law Provisions II, III, and others).

Conclusion

Although trademark valuation can be challenging, it is more nuanced and concrete than some might believe. It is often carried out using multiple methods and might involve an appraisal professional working with others, including lawyers and accountants.

Those who own or work with trademarks must understand the conceptual basis for valuation and how valuation is done to better protect the interests of trademark owners, communicate with experts, and negotiate trademark deals. Additionally, one might need to disagree with the opinion of an appraisal expert. However, such disagreement can only be expressed by understanding how to value a trademark.

As the importance of brand value rises in China and globally, it has become increasingly important for brand owners and professionals to understand methods of valuation and apply them to suit their companies’ needs.

Although every effort has been made to verify the accuracy of this article, readers are urged to check independently on matters of specific concern or interest.

© 2021 International Trademark Association